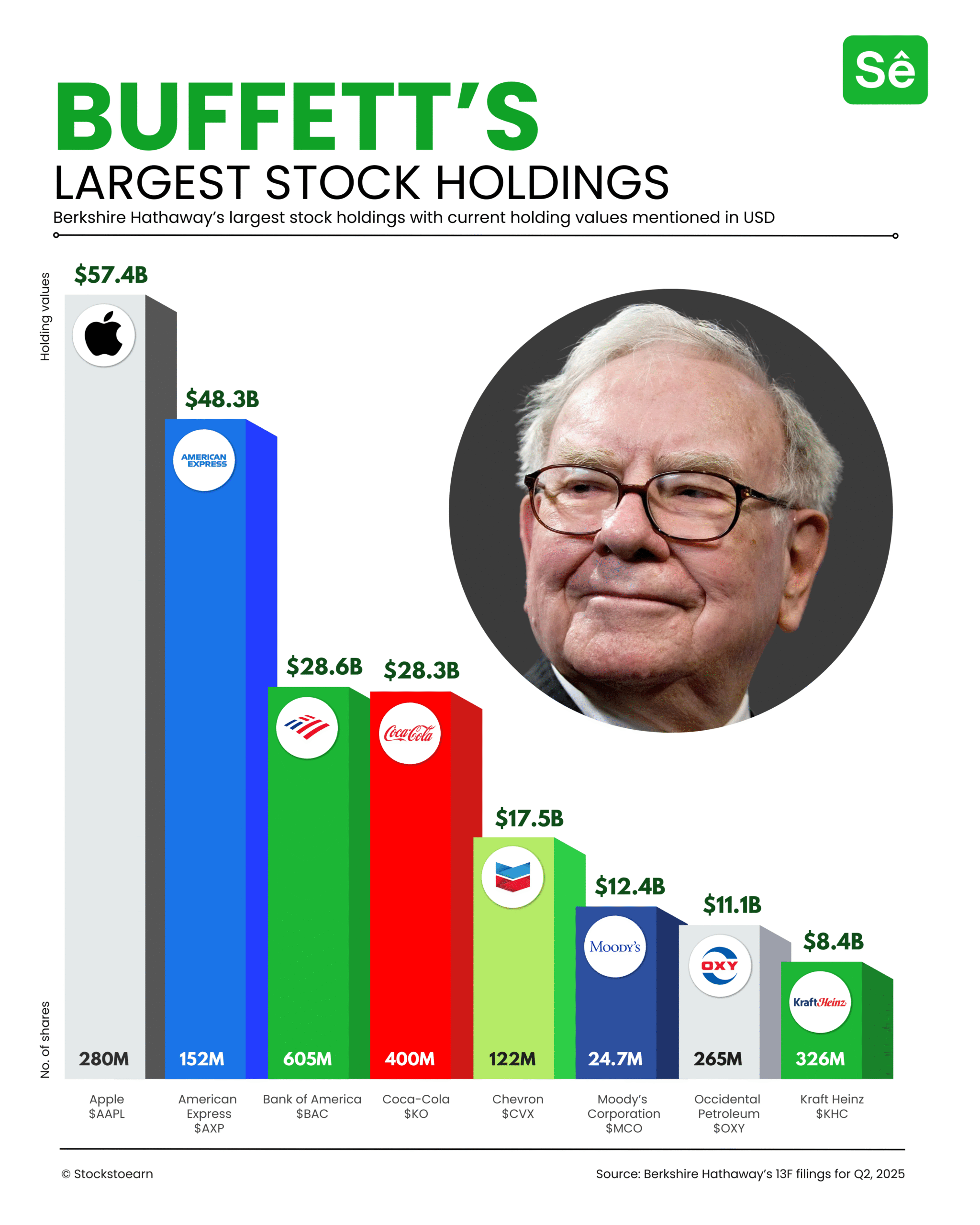

Warren Buffett's Berkshire Hathaway top 10 largest stock holdings

Here are Warren Buffett’s Berkshire Hathaway’s $257 billion portfolio’s latest top stock holdings.

⬇️ Save it for later.

These are Berkshire Hathaway’s top 10 largest stock holdings mentioned with current market values and portfolio weightage:

1. 🇺🇸 Apple: $57.4 billion (22.31%)

2. 🇺🇸 American Express: $48.3 billion (18.78%)

3. 🇺🇸 Bank of America: $28.6 billion (11.12%)

4. 🇺🇸 Coca-Cola: $28.3 billion (10.99%)

5. 🇺🇸 Chevron Corporation: $17.5 billion (6.79%)

6. 🇺🇸 Moody’s Corporation: $12.4 billion (4.81%)

7. 🇺🇸 Occidental Petroleum: $11.1 billion (4.32%)

8. 🇺🇸 Kraft Heinz: $8.4 billion (3.26%)

9. 🇺🇸 Chubb Limited: $7.8 billion (3.04%)

10. 🇺🇸 DaVita: $4.5 billion (1.75%)

Source: Berkshire Hathaway’s 13F filings for Q2, 2025

Based on latest 13F filings, Warren Buffett’s Berkshire Hathaway manages a massive portfolio worth over $257.5 billion. The top 10 largest holdings account for 87.29% of the total portfolio.

Apple @apple is still the largest stock holding of Berkshire. It owns about 280 million shares of Apple, worth over $57.4 billion. However, Berkshire has sold 20 million shares of Apple in this quarter.

American Express @americanexpress is the 2nd largest holding of Berkshire Hathaway. It owns about 151.6 million shares of American Express worth over $48.3 billion. Bank of America @bankofamerica is the 3rd largest holding of Berkshire. It owns about 605 million shares of Bank of America, worth over $28.6 billion.

Berkshire has sold 26.3 million shares of Bank of America in the 2nd quarter. It has also added 3.45 million shares of Chevron in its portfolio. Berkshire also added a new share to its portfolio, UnitedHealth in the 2nd quarter. It owns about 5 million shares of UnitedHealth worth over $1.57 billion.

Keep checking us @stockstoearn for more such insights.

Click the link in bio for more.

#warrenbuffett #berkshirehathaway #wallstreet #stockmarket #investing #wealth #finance