Stages of Stock Market

Investing Series I Education Hub

William Hamilton identified three stages to both primary bull markets and primary bear markets. These stages relate as much to the psychological state of the market as to the movement of prices.

Learning Tip

Stock market stages represent crucial stock price zones where major stock activities happen. A good knowledge of these stages will help you understand what is happing with a stock at a particular price.

Stages

Primary Bull Market

A primary bull market is defined as a long-sustained advance marked by improving business conditions that elicit increased speculation and demand for stocks. In a primary bull market, there will be secondary movements that run counter to the major trend.

1. Accumulation: Hamilton noted that the first stage of a bull market was largely indistinguishable from the last reaction rally of a bear market.

Pessimism, which was excessive at the end of the bear market, still reigns at the beginning of a bull market. This is the stage of the market when those with patience see value in owning stocks for the long haul. Stocks are cheap, but nobody seems to want them.

2. Large Movement: The second stage of a primary bull market is usually the longest and sees the largest advance in prices. It is a period marked by improving business conditions and increased valuations in stocks. Participation is broad and the trend followers begin to participate.

3. Over-buying: During the third and final stage, the public is fully involved in the market, valuations are excessive, and confidence is extraordinarily high. This is the mirror image to the first stage of the bull market.

Now let’s see the stages of primary bear market also.

Stages

Primary Bear Market

A primary bear market is defined as a long-sustained decline marked by deteriorating business conditions and subsequent decrease in demand for stocks or increase in supply.

Just like with primary bull markets. a primary bear market will have secondary movements that run counter to the major trend.

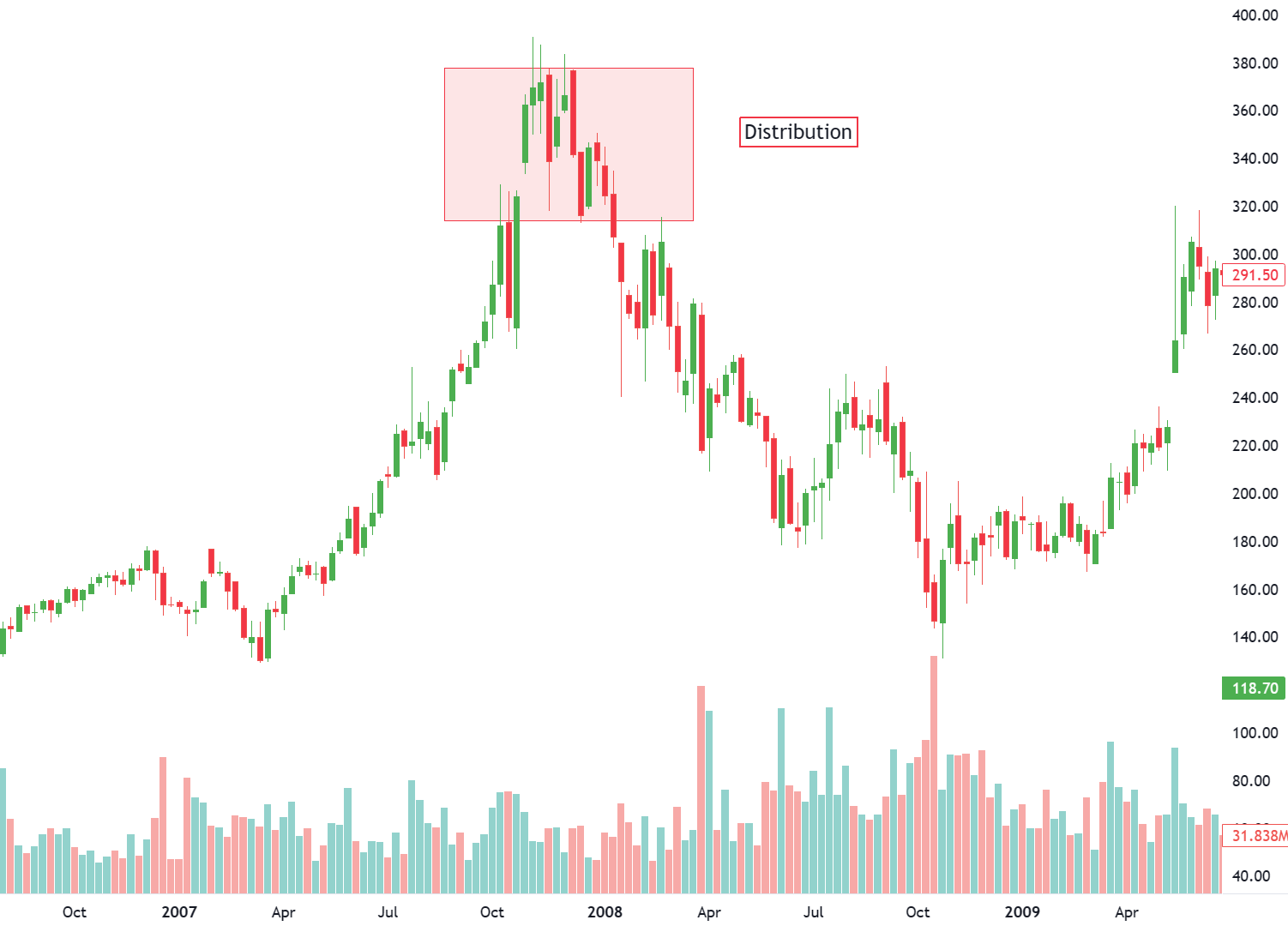

1. Distribution: Just as accumulation is the hallmark of the first stage of a primary bull market, distribution marks the beginning of a bear market.

As the “smart money” begins to realize that business conditions are not quite as good as once thought, they start to sell stocks. The public is still involved in the market at this stage and become willing buyers.

2. Large Movement: As with the primary bull market, stage two of a primary bear market provides the largest move. This is when the trend has been identified as down and business conditions begin to deteriorate.

Earnings estimates are reduced, shortfalls occur, profit margins shrink and revenues fall. As business conditions worsen, the sell-off continues.

3. Over-selling: By the final stage of a bear market, all hope is lost and stocks are frowned upon. Valuations are low, but the selling continues as participants seek to sell no matter what.

The market will continue to decline until all the bad news is fully priced into stocks. Once stocks fully reflect the worst possible outcome, the cycle begins again.

As market is a collection of various sectors and each sector has its own cycle. Many investors use diversification for long-term risk management.

The concept of diversification involves the distribution of assets within individual asset classes – while risk is distributed among the asset classes of the overall portfolio, diversification reduces risk within each asset class.

Get PRO

Get access to exclusive premium features and benefits. Subscribe a PRO plan.