Charting the Global Economy: Central Banks Diverge on Policy Path

Major Points

Argentina’s inflation soared above 160% in November ahead of President Javier Milei’s massive currency devaluation that’s likely to accelerate price increases ever further this month. The first days of December have already seen price increases of 15% compared with a month earlier, and may end the month up around 20%, according to consulting firm C&T Asesores.

The Federal Reserve, European Central Bank and Bank of England all left interest rates unchanged this week, but signaled different paths for policy going forward.

Officials in the US are prepared to cut interest rates in 2024, while those in Europe said they’d step up their exit from pandemic-era stimulus. Meantime, policymakers in the UK were more hawkish, with several still supporting a rate hike at Thursday’s meeting.

The Federal Reserve pivoted toward reversing the steepest interest-rate hikes in a generation after containing an inflation surge so far without a recession or a significant cost to employment. While Chair Jerome Powell said Wednesday policymakers are prepared to resume rate increases should price pressures return, he and his colleagues issued forecasts showing that a series of cuts would be likely next year.

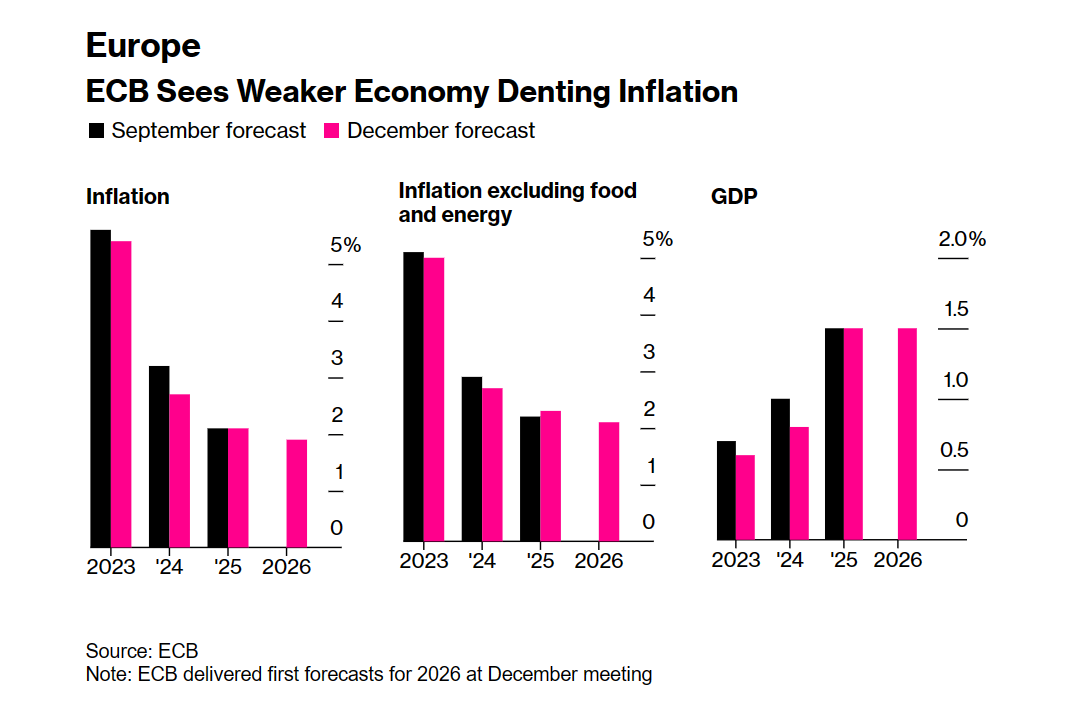

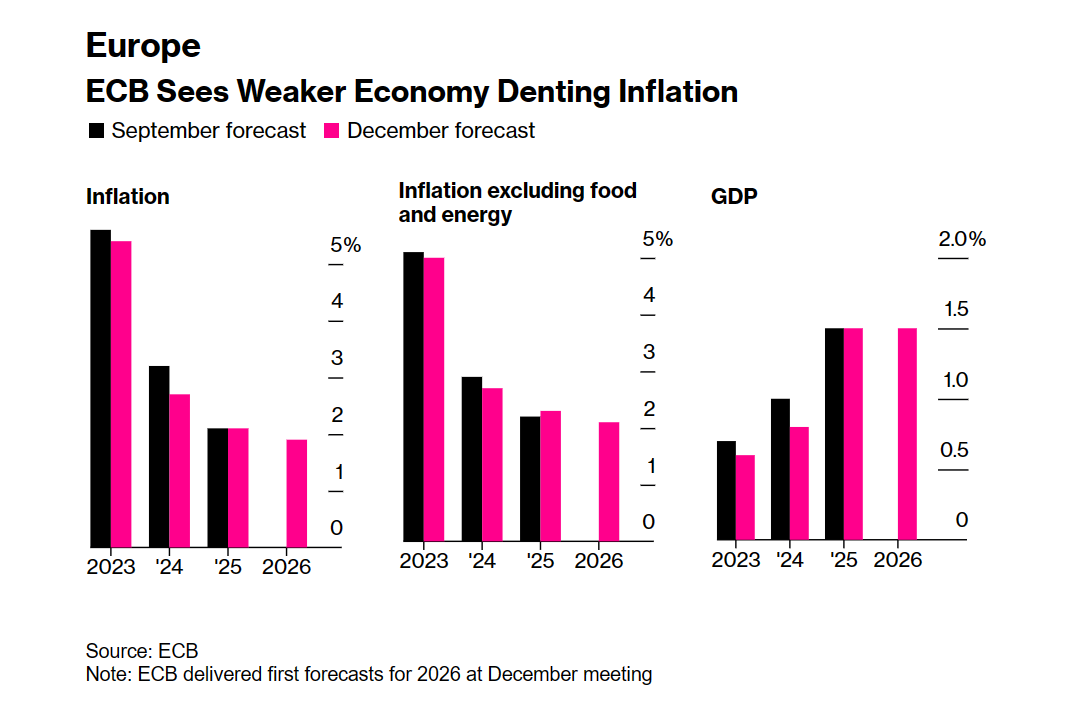

The European Central Bank kept interest rates on hold for a second meeting with inflation tumbling, but said it will step up its exit from €1.7 trillion ($1.8 trillion) of pandemic-era stimulus. Officials, meanwhile, said they’d accelerate the end of reinvestments under the PEPP bond-buying program. That will put all policy tools into tightening mode, even as fresh projections showed a weaker economy softening the inflation outlook.

Understanding

Argentina Annual Inflation Hits 161% in November

The European Central Bank kept interest rates on hold for a second meeting with inflation tumbling, but said it will step up its exit from €1.7 trillion ($1.8 trillion) of pandemic-era stimulus. Officials, meanwhile, said they’d accelerate the end of reinvestments under the PEPP bond-buying program. That will put all policy tools into tightening mode, even as fresh projections showed a weaker economy softening the inflation outlook.

The European Central Bank kept interest rates on hold for a second meeting with inflation tumbling, but said it will step up its exit from €1.7 trillion ($1.8 trillion) of pandemic-era stimulus. Officials, meanwhile, said they’d accelerate the end of reinvestments under the PEPP bond-buying program. That will put all policy tools into tightening mode, even as fresh projections showed a weaker economy softening the inflation outlook.

Get PRO

Get access to exclusive premium features and benefits. Subscribe PRO plan.